Farmland is one of the oldest and most reliable types of investments, comparable to gold when it comes to protecting wealth across generations. Unlike stocks or paper money, farmland is a physical asset, limited in supply and highly productive. As the world’s population grows and more people demand healthier food, the amount of usable farmland per person is shrinking due to city expansion and environmental damage. This makes farmland not only a stable investment, but also a smart way to protect against global uncertainty and rising inflation.

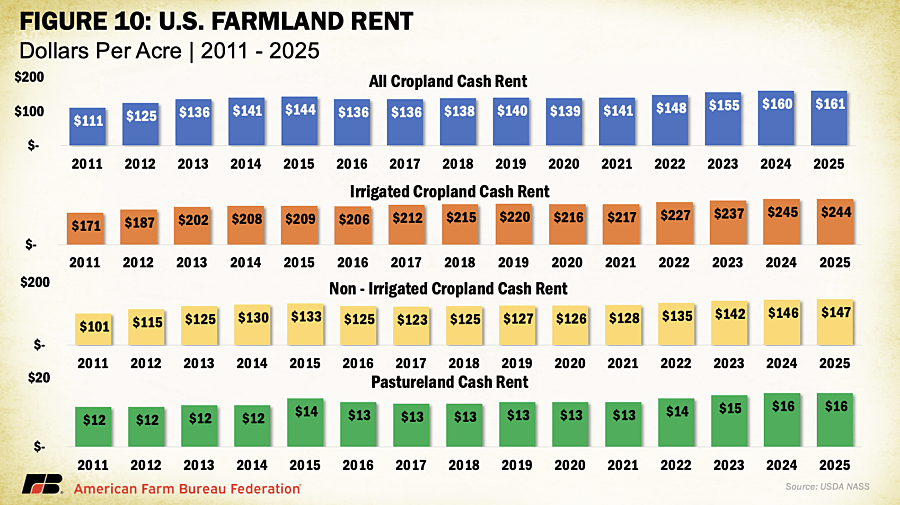

According to the American Farm Bureau Foundation , the USDA’s 2025 Land Values Report from the National Agricultural Statistics Service (NASS), the average price of farmland has gone up by 4.3%, reaching a record high of $4,350 per acre. This follows a $200 increase (5%) between 2023 and 2024 and marks the fifth year in a row that farmland values have gone up. At the same time, cash rent for cropland has reached a new high as well, rising by 0.6% to $161 per acre.

It’s no surprise that wealthy individuals like Bill Gates and Jeff Bezos are buying large amounts of farmland. It’s a low-risk investment that holds its value and steadily builds wealth over time.

Agricultural Real Estate Trends

The same USDA report confirms that agricultural land values rose by $180 per acre over the past year. The 4.3% increase brings the national average to $4,350 per acre, continuing a consistent trend of yearly growth. Cash rents for cropland rose slightly to $161 per acre, while pastureland rents remained steady at $16 per acre.

This annual data offers insight into the overall health of the agricultural sector. Higher rental costs can be a burden for farmers who lease land, increasing their production expenses. On the other hand, if land values were to decline, the value of land used as loan collateral would drop, making it harder for farmers to borrow money to cover rising input costs.

Farm Real Estate Value Overview

The national average value of farm real estate—which includes all land and buildings on farms—reached an all-time high of $4,350 per acre. This is a $180, or 4.3%, increase from last year. While it’s still a solid gain, it’s slower than the 5% ($200) rise seen from 2023 to 2024, and much slower than the sharp 11.7% ($390) jump between 2021 and 2022, which was driven by high crop prices and strong farm earnings.

Although farmland values continue to rise, the slower pace suggests the market is starting to cool. This shift could impact farmers’ financial options—slower growth in land value means they may not be able to borrow as much using their land as collateral. At the same time, lenders might become more cautious if they expect prices to level off or fall.

Regional Differences in Farmland Values

Farmland values continue to vary widely across the country, influenced by local land use demands and how profitable farming is in each region. The highest land prices are still found in parts of California, where high-value crops like vineyards, orchards, and irrigated produce create strong demand. Similarly, in the Northeastern U.S., farmland often competes with housing and commercial development, driving up prices. In areas where land is limited and close to cities, the potential for non-farming uses significantly increases value. For example, Rhode Island and Massachusetts posted the highest average farm real estate prices in the nation; $22,500 and $14,900 per acre, respectively.

The Midwest continues to hold some of the most valuable farmland in the country thanks to its focus on major crops like corn and soybeans. However, land price growth in key Corn Belt states has slowed, due to falling commodity prices and tighter profit margins for farmers. Meanwhile, the Northern Plains and Mountain West have some of the lowest farmland values, reflecting less profitable farming, fewer development pressures, and a larger share of privately owned rangeland with less productive soils.

Looking at individual states, Michigan saw the largest increase in farmland values at 7.8%, followed by Tennessee at 7.7% and South Dakota at 6.8%. These gains likely result from a combination of local factors, such as growth in specialty crops, people moving into the area, and interest in future development. Notably, no state saw double-digit percentage growth this year—highlighting a general slowdown in farmland price increases across the country.

What’s Driving Farm Real Estate Values

Farm real estate values are still largely based on expectations of long-term income. While high crop prices in 2021 and 2022 helped push land values up, especially in major crop-growing states, today’s increases are also being influenced by new government support. The 2025 American Relief Act includes $30 billion in temporary aid, with about $21 billion for natural disaster losses in 2023–2024 and $10 billion for 2024 per-acre losses under the Emergency Commodity Assistance Program. This financial support is helping boost forecasts for 2025 farm income. However, it’s important to note that this boost comes from government aid, not from improving market conditions. As a result, it may be helping to hold up land values in the short term, even though crop prices are falling and production costs remain high.

At the same time, demand for farmland continues to grow from other sectors. Solar and energy projects, remote work trends, and strong investor interest are all pushing prices higher. Many investors see farmland as a stable and inflation-resistant asset. Government programs like the Conservation Reserve Program (CRP) also play a role. CRP pays landowners to leave some acres fallow to protect the environment. These payments are based on local soil quality and rental rates. In weaker economies, some productive land may enter the program, reducing the amount of land available for farming and potentially raising land values. However, CRP was not included in the recent One Big Beautiful Bill Act, and unless Congress reauthorizes it through separate legislation, the program will end on September 30.

Cropland Values Continue to Climb

In 2025, the average U.S. cropland value rose to a new high of $5,830 per acre, a 4.7% increase from 2024. This matches last year’s growth, although it’s slower than the large jumps seen earlier in the decade. In dollar terms, cropland rose by $260 per acre year over year.

As in previous years, California and Northeastern states reported the highest average cropland values. These were followed by the Midwest and Florida, where specialty crop production and housing development continue to drive demand. The top three states for cropland value growth were Utah (9.7%), Michigan (8.2%), and Tennessee (7.8%). Notably, no state reported a decline in cropland values this year.

Pastureland Values Continue to Rise

In 2025, U.S. pastureland values increased to an average of $1,920 per acre, marking a 5% rise from 2024. This gain is similar to last year’s 5.2% increase but still lower than the 6.7% rise in 2023 and the sharp 11% jump seen in 2022, which followed nearly ten years of flat growth.

Unlike cropland and overall farm real estate, the highest pastureland values are found along the East Coast and in the mid-South. In these areas, limited land availability, strong development pressures, and growing lifestyle demand help push prices higher. By contrast, average pastureland values are lower in the Western and Plains states. This is due in part to less productive soils and the wide availability of federally owned grazing land, which ranchers access through permits—reducing the need for private land purchases and market competition.

In the more densely populated Eastern states, rising demand for open space, whether for grazing, outdoor recreation, or rural living continues to drive up the cost of the relatively small amount of privately owned pastureland available.

Cash Rent Trends in 2025

The National Agricultural Statistics Service (NASS) also released its 2025 data on cash rents figures that often trail behind land values and commodity prices, since many lease agreements are made before the start of the season. While this data reflects past rental agreements, it still serves as a key reference point for future lease negotiations, especially in regions where rent structures vary from year to year.

In 2025, the average U.S. cropland cash rent rose slightly to $161 per acre, a modest increase of just $1 (or 0.6%) over 2024. Irrigated cropland rents fell by 0.4% to $244 per acre, while non-irrigated rents edged up 0.7% to $147 per acre. Pastureland rents held steady at $15.50 per acre.

Even though nationwide changes were minor, local markets continue to feel upward pressure from non-agricultural demand, especially in areas where land is increasingly sought for solar energy, suburban development, or recreation. Remote work trends are also drawing more people into rural areas, increasing competition for land in scenic or fast-growing regions.

Earlier spikes in rent were closely tied to the 2021–2022 commodity price surge, but today’s shifts are more uneven. Factors like water availability, changing crop choices, and federal disaster assistance are playing a bigger role. In some areas, federal aid may be preventing rents from falling, even as crop prices drop and input costs stay high.

Top states for cropland rent growth in 2025 included Washington (up 10.7%), Montana (8.2%), and Alabama (8.1%). In contrast, rents dropped by more than 5% in Hawaii, New Mexico, Wyoming, West Virginia, and Massachusetts, likely due to easing drought concerns, changing land use trends, or market corrections following rapid growth in prior years.

By dollar value, the most expensive cropland rents remain in states with high-value specialty crops. California leads at $346 per acre, followed by Arizona ($334) and Hawaii ($295) rates often linked to the presence of irrigation systems and water rights. States like Iowa, Illinois, Indiana, and Washington also report high rents due to a mix of large-scale row crops and specialty crop production. Access to water remains a key driver of both land values and rental rates across the Western U.S.

For farmers who lease most of their land, especially beginning farmers without land equity, the financial picture is becoming more difficult. As income projections decline and rent costs stay high, even small increases in rent can cause significant strain. Without additional government support, many producers may face tighter margins and reduced access to credit, making 2025 a challenging year for those operating on rented land.

Categories: Real Estate